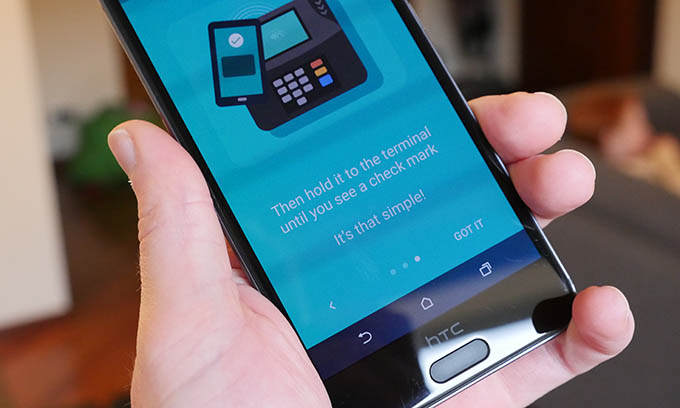

Just another typical day. You’re in a rush when you find something you like. There’s no time to thumb through your cash or scribble out a check. Thankfully, there’s a faster solution: Android Pay with your HTC phone. A quick tap or speedy swipe and you’re on your way with your latest purchase. With nearly 17 percent of the population already using NFC payment, the new method is gaining momentum. There is simply no easier way to complete a sale in today’s digital economy.

By 2017 the expected transaction total will be nearly $720 billion thanks to the advances of Google, Samsung, Apple, Android, and PayPal. From American Express to Bank of America and Citi, traditional institutions are backing the financial fingerprint of today’s technology leaders.

The hours of complicated paperwork and frustration of configuring a new payment method typically associated with such ventures are absent with NFC payment. Simply find a great credit card deal and punch the information into your mobile device. Next time you’re on the run and see a pair of shoes you can’t pass up, know you’ll only need a second to own them. And, as if NFC payments weren’t already convenient enough to use daily, industry leaders are constantly working to improve the experience. So what’s next? Glad you asked.

Rewards Programs

Convenience and bonuses? Yes, please. Android Pay is giving you even more incentive than you need to start using NFC payment. A recent partnership with Google resulted in the birth of a rewards program that offers store credit to one of the most renowned technology companies on earth. Earn free music or Chromecast devices when selecting to pay with your Android on in-store purchases. The initiative — labeled Tap 10 — is expected to raise awareness for the mobile wallet.

It’s estimated that 44 percent of users will take the service for a spin if there is a rewards program to lean on. Earning gifts is simple: just download the app and open it to the welcome screen. After that, all you need is a mobile checkout to be entered to win.

Increasing the Number of Associated Financial Institutions

Banks are jumping all over the opportunity to get into a new business. Some NFC services feature over 900 participating institutions while adding more daily. Citizens Bank, PNC, and BB&T have signed on while credit unions across the country back the movement. Of course, the most prominent credit card companies also support NFC payment. Visa, Capital One, and Chase all comply with the new, and faster, payment method.

Introducing New Technologies to Smartphones

The ever-evolving world of technology reached this pinnacle by pushing the limits. That isn’t stopping any time soon. As evidenced by recent headlines, cellular providers are now placing actual NFC chips into devices. What was already an easy process is becoming even more effortless. Both Android and Apple have integrated such innovations to their new line of products.

Expanded Geographical Markets

Vacationing in the U.K.? No problem. Visiting Australia? You’re covered. How about catching your favorite team in Canada? NFC payment is available there too. No matter where you end up on the map, you can count on your mobile device to complete transactions. The safety and versatility of NFC payments is making the approach a must-have across the world.

Applications for expanded payment are expected to heavily increase in Europe and Asia over the next year. As awareness rises, so do the number of outlets in compliance with the system. Areas such as Japan and Germany are catching on and catching up.

Expanded Retail Locations

From Rite Aid to McDonalds, outlets everywhere accept NFC payment. Carrying a wallet is no longer necessary — unless it’s your digital wallet. Small retailers and large chains alike ensure that your transaction process is as painless as possible. And, in case you’re not certain of where you can use your smartphone to pay, install an app or checkout your provider’s website to see where it’s accepted.

New terminals are popping up everywhere as the world catches on to the industry. It’s virtually impossible to drive down a street that doesn’t provide the option. So, next time you’re short on cash but still looking to paint the town red, remember that your funds are literally right at your fingertips.